The Seven Fundamental Principles of Investing are used by all the successful investors. Though the market analysts have to dig in a lot deeper to have an in depth knowledge of the company. In case we have a buying interest in a particular company’s stock, then we should consider passing it through the litmus test of these seven fundamental principles. It is after passing a company through these steps, we gather a good amount of information to be able to make a positive or a negative decision to invest in that particular stock. Also note that the investments we are talking of here are purely long term and not short term intraday trading. A long term investment is expected to be held for a period of more than one year, in general terms. Here we consider a minimum holding period of three years for it to be termed as long term. These type of investments usually have a lower risk and a higher potential for a long term growth and appreciation. If investors really have an appetite and patience to have a taste of multi-bagger returns, then the investment period has to be even longer than three years. As per the market guru Warren Buffet, long term is forever.

1.) Stock’s Chart Pattern

To elaborate a little, this means that the stock has generally seen an increase in price over the time. However, there have also been periods of time where the stock has seen a decrease in price, such as during the market downturns or when the company has released disappointing or unexpected financial results.

If the chart patten of a company’s stock from the time it went public till the present times shows an uptrend, then we can give a thumbs up on this point.

Example:Apple Inc- The chart pattern of Apple’s stock price overtime would generally be considered an uptrend. This means that the stock has generally seen an increase in price overtime. However, there have also been periods of time where the stock has seen a decrease in price. In long term, apple stock has grown significantly since its initial public offering (IPO) in 1980, with the price increasing by several thousand percent

2. Promoter’s Holding in the Company

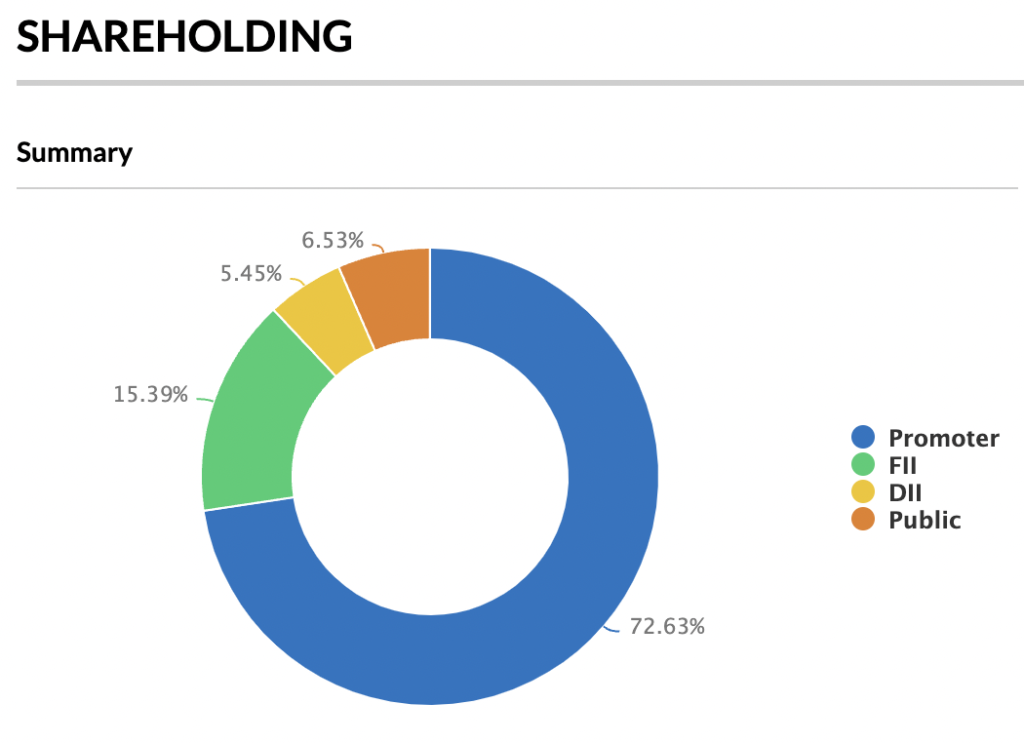

Our second guiding principle would be, “50% or above promoter’s holding in the company”. A 50% and above promoter holding in the company definitely provides a peace of mind and indicates some seriousness on the part of its promoters who are running the company. Though, this is definitely not a benchmark one should follow, as there are examples of companies with a lot lower promoter holding percentage, doing phenomenally well and vice versa.

Promoter holding in the graph is 72.63%, and rest of the holding is with the foreign institutional investors, domestic institutional investors and the public respectively.

What is the “Promoter’s Holding”?

A promoter is an individual or group of individuals who have a significant influence on the management of a company, often through ownership of a large number of shares. The shares owned by a promoter are referred to as “Promoter’s Holding”. These shares give the promoter a significant level of control over the company, including the ability to appoint members of the board of directors and make major strategic decisions. In most cases, promoters are considered insiders of the company and are subject to certain legal restrictions on their ability to buy and sell shares.

3. Promoter’s Stock Pledge

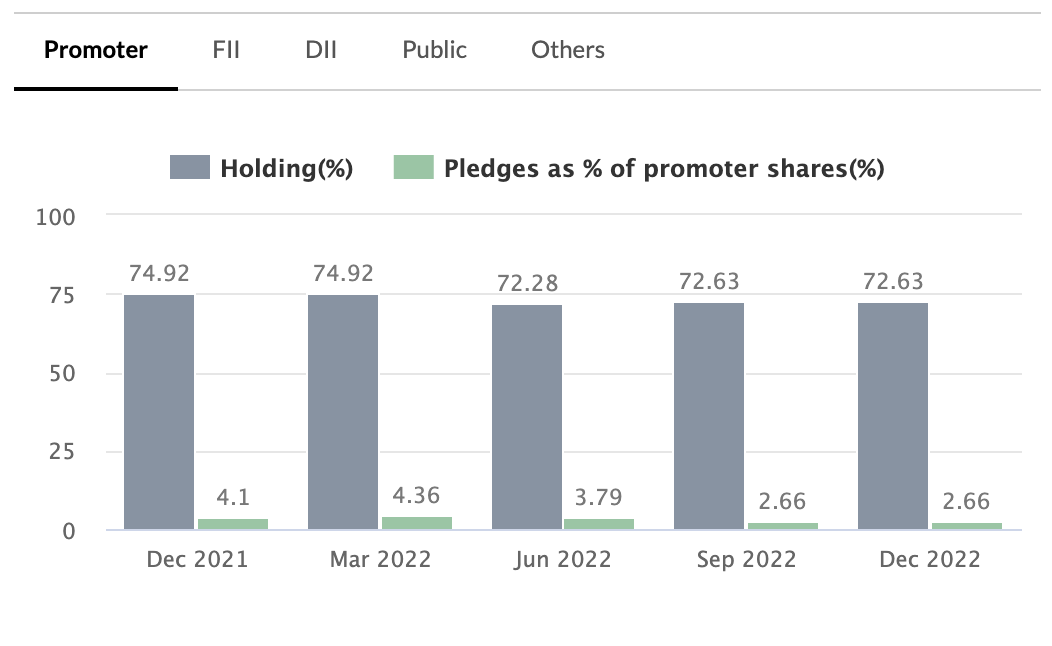

Preceding the “promoter’s holding comes the third criteria, known as “promoter’s pledge”. As per this principle “percentage of shares pledged by the promoters of a company should be within 20%”, anything over and above that can make the company vulnerable. Some of the investors consider this guideline to a level of 25% also. Though many factors are to be seen in this case, e.g., if the promoters are using the generated funds towards the growth of the company or for personal reasons, whether the company is showing consistent growth in its quarterly results, etc

The grey graph shows the promotor’s holding in the company, and the green graph shows the percentage of shares pledged. You can see that there is a gradual decline in the pledges every financial quarter.

What is promoter’s pledge?

Promoters pledge refers to the process where the promoter of a company pledges a certain portion of their shares as collateral for a loan. This means that the promoter is giving the lender the right to sell the pledged shares if the promoter is unable to repay the loan. This is often done to raise funds for the company or for personal use. Pledging shares can be a sign of financial distress for the company, as it indicates that the promoter is in need of cash and is willing to risk their ownership in the company in order to get it. The percentage of shares pledged by a promoter is called pledge percentage, it is important to know that, if the pledge percentage is high, it can be a sign of increased risk for investors.

4. Debt Profile of the Company

As per this fourth principle, “Debt profile of the company provides a picture of the company’s financial health”. A debt free company is definitely the safest bet, but the company having debt and showing signs of growth and bringing the debt down in regular intervals is a positive indication too. On the other hand a company piling up huge depts may have negative impact on the growth as it is always fighting to pay heavy interests on it.

What is debt?

Debt refers to the amount of money that the company owes to creditors, such as bondholders or banks. This can include loans, bonds, and other forms of borrowing. Debt can be used by companies to finance operations, expansion, and investments. It is important for a company to manage its dept levels effectively in order to maintain financial stability and avoid defaulting on loans.

5. Mutual Funds/ FPI/ FII/ Insurance Holdings in the company

Principally, ”Mutual Funds/ FPI’s/FII’s/ Insurance, holding equity in a company is a positive sign”. This shows their trust in that company and a positive outlook on its future growth. Their holding of shares in the company gives the investors some confidence on company’s future, hence is considered as one of the important criteria’s in investing.

What are Mutual Funds?

Mutual funds are investment vehicles that pull money from multiple investors to purchase a diversified portfolio of securities, such as stocks bonds, and real estate. Mutual funds are managed by professional money managers and can be bought and sold on a daily basis.

What are FII’s and FPI’s?

FII foreign institutional investor and FPI foreign portfolio investor are terms used in India to refer to entities that invest in the Indian stock market from outside of the country. These investors can include mutual funds, pension funds, and other institutional investors.

What are Insurance holdings?

Insurance holdings in a company refers to the ownership of the company’s stocks or bonds by an insurance company. Insurance companies may purchase these securities as part of their investment portfolio in order to generate income for policy holders and shareholders.

6. About the Company

Principally “doing due diligence on the company to be invested is a must”. The investors should do a proper due diligence on the company before investing in it. To find out all about the company, one must go through its official website. This shall give some clarity of the sector the company is working in, who are their clients and all the required relevant information on the company.

What is due diligence on a company? Due diligence is the process of thoroughly researching and evaluating a company before making an investment decision. It involves analysing the company’s financial statements, management and governance, industry and market conditions, legal and regulatory compliance, competitive position risks and future prospects.

7. Management Team

Principally, “a Company should have a solid management team” . Having confidence in the management of the company who is responsible for running the entire show is very important for the investors. As investors we are owning a part of the company as equity in the said company. It then falls to our responsibility to know about the key people running the company. Taking care of this criteria we try and ensure the safety of our investment. You can even find the information on the CEO, CFO, managers, etc of any particular company on google.

What is company management and the management team? Management of a company refers to the process of planning, organising, directing and controlling the operations and resources of the organisation in order to achieve its goals and objectives. The management team of a company it is responsible for making strategic decisions, implementing policies and procedures, and ensuring that the company’s operations are running smoothly and efficiently.

Finally, if you have diligently gone through all the seven steps for analysing the company’s investment worthiness then your investment decision is going to be a logical one.